RTX FY2025 Q1: Aerospace Ascends, Defense Delivers – Tackling Tariffs Head-On

$RTX RTX Corporation FY2025 Q1 Earnings Highlights. Welcome to EquityTLDR’s Substack! Learn about stocks, businesses, news and gain perspectives for your investment research!

RTX kicked off 2025 with impressive momentum, showcasing the power of its combined aerospace and defense portfolio. Despite global jitters and looming trade hurdles, the company delivered results that beat expectations, painting a picture of operational strength and robust demand across its key markets. Let's dive into the flight plan for Q1 and what it signals for the journey ahead.

🚀 Firing on All Cylinders: Q1 Delivers Growth & Cash Flow Punch

RTX didn't just meet the mark in Q1; it accelerated past it. The financial dashboard lit up with green across core operational metrics, demonstrating the company’s ability to navigate a complex environment and convert demand into tangible results, setting a strong pace for the year.

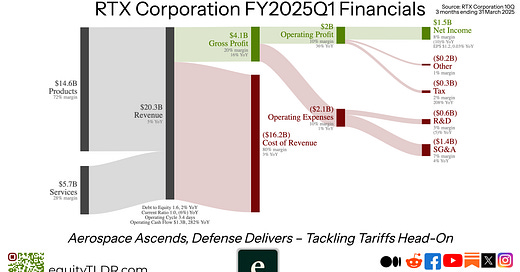

📈 Sales Surge: Net sales climbed a healthy 5.2% year-over-year to hit $20.3 billion, but the real story is the potent 8% organic growth once divestitures are set aside.

💰 Profit Power: Adjusted earnings per share (EPS) jumped 10% to $1.47, significantly outperforming analyst forecasts and highlighting strong execution, even as GAAP EPS dipped to $1.14 due to acquisition accounting adjustments.

💸 Cash Conversion: Operating cash flow saw a massive 282% leap to $1.3 billion, flipping free cash flow from negative last year to a positive $0.8 billion – proof of tightening operational screws and better working capital control.

⚙️ Margin Momentum: Adjusted segment profit swelled 18% to $2.5 billion, driving a solid 120 basis point expansion in adjusted segment margins, showing leverage and efficiency gains.

The Takeaway: This strong financial launch wasn't just about hitting numbers; it’s about generating the cash fuel needed for future investments, debt management, and shareholder returns ($0.9 billion returned in Q1), all while proving the core business engine is running smoother and stronger.

🛠️ Aftermarket Takes Flight: Collins Soars on Service Demand

Collins Aerospace truly spread its wings in Q1, acting as a major lift engine for RTX's overall growth. The continued resurgence in air travel translated directly into booming demand for keeping existing fleets flying high and generating significant high-margin revenue.

✈️ Service Superstar: The standout performer was commercial aftermarket, rocketing up by 21% organically as airlines flew more hours, driving demand for maintenance, repairs, and spare parts.

📈 Steady Ascent: Commercial original equipment (OE) sales also chipped in with a 3% rise, alongside robust performance in defense sales within the segment.

📊 Reported Revenue: Collins booked $7.2 billion in sales for the quarter, showcasing its significant scale within the RTX portfolio.

Why It Matters: Collins' aftermarket muscle provides a crucial, profitable counterweight to the cyclical nature of new aircraft sales. This reliable income stream is gold, but it also means Collins is front-and-center in the battle against potential tariff impacts on materials costs.

💨 Powering the Future: Pratt's GTF Gains Altitude, Faces Hurdles

Pratt & Whitney (P&W) continued its critical role, pushing forward with next-generation engine technology while capitalizing on the demand for both new powerplants and services for the existing fleet. Progress on key certifications was a major win, bolstering confidence in its flagship commercial product line.

🏆 GTF Advantage Certified: Receiving FAA certification for the upgraded GTF Advantage engine was a landmark achievement, promising better fuel burn and thrust for customers like Airbus.

🏭 Delivery Drive: P&W contributed significantly to growth through both OE deliveries (like the GTF for A320neos) and a growing aftermarket footprint as its engine fleets mature.

📈 Strong Showing: The segment reported impressive sales of $7.4 billion, underscoring its importance to RTX's top line.

The Bottom Line: P&W's trajectory is tightly linked to the success and reliability of the GTF engine family. While the Advantage certification is a boost, managing ongoing engine inspections (related to powder metal issues) and navigating its own significant tariff exposure remain key operational challenges.

🛡️ Defense Holds the Fort: Raytheon Secures Future Amidst Global Tensions

The Raytheon segment provided stability and strategic wins, capitalizing on heightened global defense spending. Even with a slight dip in reported sales due to a past divestiture, the underlying defense demand proved resilient, locking in future revenue streams.

📉 Divestiture Dip: Reported sales came in at $6.3 billion, down 5% due to the sale of its cybersecurity unit, but organic defense sales across RTX actually grew 4%.

🏆 Milestone Moment: A huge win was the Lower Tier Air and Missile Defense Sensor (LTAMDS) program hitting "Milestone C," officially shifting this advanced radar system into production for the U.S. Army – a cornerstone for future growth.

🌍 Global Grab: Raytheon secured over $19 billion in new awards in Q1, benefiting significantly from increased international defense budgets, particularly in missile defense systems sought by allies.

Strategic Significance: Raytheon is RTX's anchor in turbulent geopolitical seas, offering counter-cyclical strength. Landing major programs like LTAMDS and capturing burgeoning international demand are vital for long-term success, especially as this segment faces less direct tariff pressure than its commercial siblings.

🚧 $850 Million Question Mark: Can RTX Sidestep the Tariff Trap?

While Q1 results shone, a significant shadow looms: potential tariffs. Management spent considerable time outlining a potential $850 million pre-tax profit headwind for 2025 if various U.S. and international tariffs take full effect without successful countermeasures.

💸 Hefty Hit: The $850 million potential impact is spread across multiple tariff categories (Canada/Mexico, China, Global Reciprocal, Steel/Aluminum) and primarily threatens Collins and P&W (over $400M each).

🛡️ Mitigation Mission: RTX is deploying a full arsenal of defenses: seeking exemptions, leveraging trade agreements (USMCA), using import bonds and drawbacks, adjusting sourcing, and exploring pricing actions. The $850M figure is net of these planned efforts.

❓ Guidance Gamble: Crucially, this potential hit is not baked into RTX's current 2025 financial guidance due to the uncertainty surrounding the tariffs' final form and duration.

The High Stakes: This tariff uncertainty is the single biggest variable clouding RTX's otherwise strong outlook. Successfully navigating this complex trade landscape through savvy mitigation is now job number one to protect profitability and meet underlying financial goals.

📚 $217 Billion Strong: RTX's Order Book Fuels Future Flight Path

Beneath the quarterly numbers lies a bedrock of stability: RTX's massive backlog. This colossal order book provides exceptional visibility into future revenue streams across both commercial aerospace and defense, significantly de-risking the company's outlook.

📈 Record Reservoir: The total company backlog swelled to $217 billion by the end of Q1, up approximately 8% from the prior year.

⚖️ Balanced Book: This backlog is strategically split, with $125 billion attributed to commercial aerospace (driven by long-term engine and component orders) and $92 billion anchored in defense contracts.

🔭 Future Fuel: This isn't just a big number; it represents years of secured work, providing a buffer against market fluctuations and underpinning confidence in long-term growth plans.

Forward Look: This immense backlog is RTX's strategic advantage. It allows the company to plan investments, manage resources effectively, and provide stakeholders with a degree of certainty rare in many industries, ensuring a baseline level of activity for years to come.

🧭 Guidance Grounded, Ambitions Airborne: RTX Charts Course for 2025

Despite the tariff thunderclouds, RTX held firm on its full-year guidance, signaling confidence in its underlying business strength and operational capabilities. The challenge now is executing flawlessly while managing external pressures.

🎯 Targets Intact: Management reaffirmed its 2025 outlook: adjusted sales of $83-$84 billion, adjusted EPS of $6.00-$6.15, and robust free cash flow between $7.0-$7.5 billion (all excluding potential tariff impacts).

⚙️ Execution Engine: The path forward relies on continued strength in the commercial aftermarket, diligent execution of the defense backlog (especially programs like LTAMDS), and pushing innovation with products like the GTF Advantage.

⚖️ Balancing Act: Key priorities involve driving operational efficiency for margin gains (tariff impacts notwithstanding), navigating supply chain complexities, and strategically allocating capital between growth investments, debt reduction, and shareholder returns.

The Final Approach: RTX is flying high on operational success and a massive backlog, but it's navigating serious potential turbulence from tariffs. The reaffirmed guidance speaks volumes about management's belief in the core business, but achieving those targets will require exceptional skill in mitigating external risks while keeping the internal engines running at peak performance throughout 2025.

Disclaimer: This content is purely for informational purposes. Please don't take it as financial, investment, legal, or tax advice, or as a nudge to buy/sell anything specific. Since AI helped create this using various sources, the info might be outdated, or miss some human nuance. People involved here might own securities discussed and could trade them anytime without notice. Remember, investing involves risk (including illiquidity and losing your capital!). We're not acting as your fiduciary. Always do your own homework and talk to qualified professionals before making financial moves.